Why Caribbean campaigns struggle (and what to do instead).

People in the Caribbean don’t need more “marketing tips.” They need a reality check—and a plan that actually works.

Let’s get some definitions straight.

There are marketing campaigns: those long-haul efforts that build brand love and reputation. They’re about recognition, not revenue. The results are abstract. The data is vague. And in the Caribbean, let’s be honest—our infrastructure makes proper tracking feel like chasing fog with a butterfly net.

Then there are sales campaigns: promotions, product launches, discount drives. These are meant to convert. They’re short-term. They’re trackable. But here’s the kicker—most businesses expect the results of a sales campaign from a marketing campaign. That’s like planting a mango tree and expecting smoothies the next day.

This mismatch creates tension. Agencies overpromise. Clients underprepare. And nobody addresses the elephant in the WhatsApp group: the systems to support these campaigns barely exist.

A scenario:

A business says, “We need more sales.”

But their checkout process? A 12-step maze with a CAPTCHA that might as well ask for a blood sample.

That’s not a sales funnel—it’s a sales trap.

So what do we do?

We improvise. We build workarounds. We use Wise and Payoneer and borrow foreign addresses from our friends and family. We pay processing fees then wire transfer fees.

Here’s how to make the most of what we do have:

- Get a campaign phone. Buy a cheap one, slap in a SIM card, and use it exclusively for campaign leads. If that phone rings, you know your ad worked. Budget for it.

- Use WhatsApp Business. Build a product catalog—even if you sell services. Automate replies. Set up shortcuts like “address” = your actual address. Speed matters.

- Track with Google Sheets. Spreadsheets are the universal language of business systems. They’re CRM training wheels. Keep them clean and consistent—you’ll thank yourself later. Here’s a free template.

Now let’s tackle the big myth:

Do campaigns make money?

Yes. But only if they’re plugged into a system that lets people pay you.

And that’s the real problem, isn’t it?

Online payments in the Caribbean are a nightmare.

Not because people don’t want to pay—because they can’t. Banks, processors, and platforms haven’t caught up to the street hustle. Go ask a vendor on Ariapita Avenue to set up API payment gateways—then duck the cuss you’re about to get.

Cash is still king because it’s simple. It’s immediate. And yes—it’s tax-free.

So why would someone trade ease for friction?

Meanwhile, in Thailand, street vendors have QR codes and tap-to-pay. Here? We have a line at the ATM.

The problem isn’t the people. It’s the environment.

The Caribbean makes it too hard to run an efficient business.

From payment systems to customer support to shipping—everything is duct tape and good vibes.

Even when we get inspired by a “$290K in 3 days” campaign story from the US, we forget that those wins came after years of brand building. We skip the prelude and wonder why our story flops.

Here’s what I think Caribbean businesses should do:

Start a drip adoption campaign.

- Make it stupid simple to order. Phone or WhatsApp. Flat delivery fee.

- Ditch Cash On Demand. Crime makes it risky. Get a mobile Linx machine or use a company like oDeliver.

- Observe before automating. Watch how customers behave for 3 months.

- Then build a digital checkout. Not because it’s sexy—but because now it’s needed.

And here’s the hard truth: This will take money.

The same banks slowing you down are the ones charging setup fees to “upgrade” you. And even if you cough up the cash, you’ll still face cultural resistance.

For quick reference, here’s what Scotia charges (as of April 2025):

Hot.

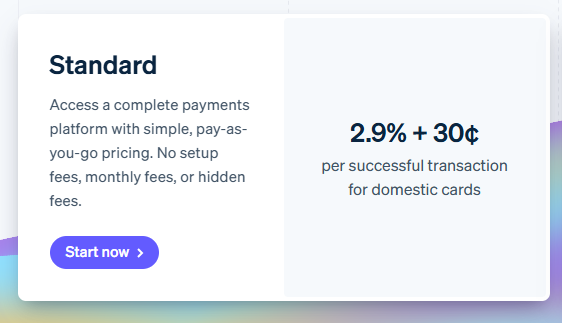

For comparison, this is what Stripe charges (as of April 2025):

Sigh.

—

Quick Facts:

- Think about Stripe becoming fully active in Trinidad and Tobago for example. That would require consultation with the government and a complete overhaul of the legislation that facilitates online payment (this is another story by itself). That will take years of effort and legal fees to complete, all for a population of only 1.4 million people.

- If they get half the population to use Stripe, that’s only 700,000 people, all dealing with TTD. Meanwhile in 2023, Stripe dealt with an estimated $1 trillion USD in payment volume.

- For a quick stat on PayPal, they had 434 million active accounts in 2025, with over 36 million merchant accounts in 200 markets worldwide. Coming into a small space like Trinidad just doesn’t make sense.

- If the whole Caribbean united under one currency, and presented ourselves as one region however, then it would make more sense, but even then, we’d only be at 44.59 million people in the whole region.

- To put this into perspective, New York alone has just under 20 million people living in it. England by itself has 56.5 million people. You see, it’s a matter of scale and profitability.

—

Even the biggest businesses in the Caribbean still make most of their money via cash, cheque, and Linx.

That’s not a criticism. That’s a wake-up call.

Until the infrastructure catches up, you’ll be fighting an uphill battle.

You’re running a marathon in sandals. Possible? Yes. Fun? Absolutely not.

But you can still win. Just don’t fall for the glossy YouTube promises of “overnight success.”

This isn’t Silicon Valley.

This is the Caribbean. And our version of progress is slower, messier—and far more creative.

So stop copying. Start adapting.

And when in doubt?

Build it the way people already behave.

You’ll make money. You’ll build trust.

And when the rest of the region finally catches up, you’ll already be there—waiting.